Free Tax Assistance Information 2024 Tax Season- Thursday, January 18th – Monday, April 15th

Palm Beach VITA Sites

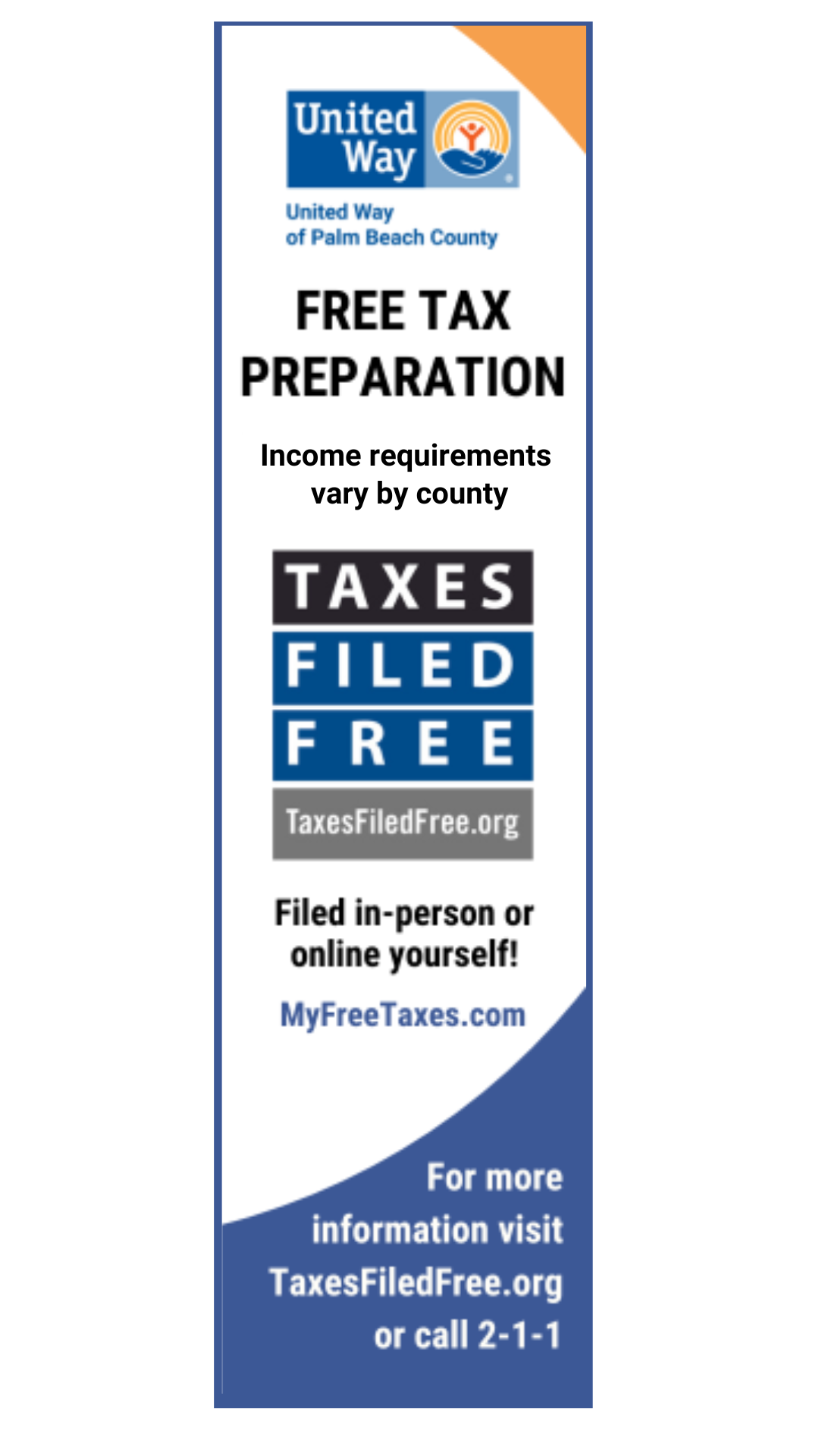

The Taxes Filed Free Campaign provides free, confidential, and secure preparation and e-filing of tax returns to qualified taxpayers. To qualify, taxpayer’s income must have been $75,000 or less in 2023. Taxpayer’s may be eligible for up to $7,430 in Earned Income Tax Credits (EITC).

Due to COVID-19 United Way of Palm Beach County will offer free tax preparation services following recommendations from the CDC and Florida Department of Health.

Taxes Filed Free gives you two options to choose from to e-file your tax return. All options are supported by IRS-Certified Volunteer Income Tax Assistance (VITA) volunteers. All VITA sites accommodate individuals with a disability. The VITA sites are grouped by region of the county and listed alphabetically by city.

Filed For You – Face-to-face socially distance tax preparation provided at several county VITA sites, no appointment required. For more information and/or to find a nearest location visit www.TaxesFiledFree.org or call 211

Filed Yourself – Visit www.MyFreeTaxes.com and file your own tax return. It’s simple, fast, and secure. If you have a tax or software related question, you can submit a question by email, webchat, or call the helpline for support.

Please bring the following items to the VITA site to make it easier to prepare your return:

· Last year’s Federal Income Tax Return (2022 income tax returns)

· Social Security Cards for you, your spouse (if married), and all dependents

· Correct birth dates for all names that appear on the return

· All W-2’s for 2023, including spouses

· Form 1098 – Mortgage interest, property taxes

· Form 1099 – DIV, G, INT, MISC, Q, R, RRB, SSA for 2023

· Voided check and savings account number for direct deposit of your refund (This is optional, but it gets your cash to you fast)

· A Photo ID card (driver’s license, etc.), including spouse’s, if married and filing joint returns

· For Dependent Care Credit, bring care provider’s name, address, SSN/EIN, and amount you paid

· For Education Credit, bring 1098T or 1098E and amount paid for qualified expenses

· For Premium Tax Credit, bring 1095-A (Health Marketplace Statement)

If married and filing a joint return, both spouses must come to the VITA site.

VITA volunteers will NOT prepare Schedule D (Complex), Schedule E, Employee Business Expenses, Moving Expenses and Nondeductible IRA.

Palm Beach County Library Branches- AARP Foundation Tax Aide Sites:

Bring current tax documents and 2022’s completed tax returns.

Gardens- (561) 626-6133

Hagan Ranch Road- (561) 894-7500

Okeechobee Blvd.- (561) 233-1880

For times and additional information call or click here…

Treasure Coast Free Tax Preparation Information and Sites

Include VITA and AARP Foundation Tax Sites

AARP Foundation Tax-Aide offers free tax return preparation to anyone who needs it. AARP Foundation Tax-Aide volunteers are trained to help you file a variety of income tax forms and schedules.

In certain situations, however, volunteers may be unable to provide assistance. The Volunteer Protection Act requires that our volunteers stay within the scope of tax law and policies set by the IRS and AARP Foundation.

VITA is a group of volunteers in the community who are trained and certified by the Internal Revenue Service. Many of the volunteers have a strong background in accounting, bookkeeping, or previous VITA experience. Many have no experience, but are willing to learn! VITA sites prepare and e-file form 1040 and prepare returns within the volunteer's level of training and the scope of the VITA program. Those with more complicated returns may be referred to other locations. The volunteers treat all clients professionally, with courtesy and respect. Safeguarding the confidentiality of the client is a priority at all VITA sites! For more information click here.

Please note that as other county sites come online we will post.

The FREE Tax Assistance sites are provided to help families who earn less than $60,000 annually to avoid:

Having to pay for tax preparation and

Paying high interest and fees on rapid refund loans.

With e-file and direct deposit, you can get your returns in as quickly as 10 days! MyFreeTaxes.com

For those who make less than $73,000. They can prepare their own taxes using the “My Free Taxes” at the link: www.unitedway.org/myfreetaxes.

United Way of Indian River County

United Way of Indian River County and the IRS Volunteer Income Tax Assistance (VITA) program is offering free tax preparation and e-filing services to qualified residents with an annual household income at or below $64,000.

Hardworking families may miss out on substantial tax credits if they don’t have assistance filing their tax returns. All United Way VITA volunteers are IRS-trained and certified annually and provide free tax return preparation with electronic filing to qualified individuals in Indian River County. In addition, tax preparers ensure that taxpayers receive credits due to them, such as Earned Income Tax Credit, Child Tax Credit, and Credit for the Elderly or Disabled.

Appointments can be made online at UnitedWayIRC.org/taxes or by calling (772) 203-5766.

Tax filing will start on Thursday, February 1st. Clients must bring a valid picture ID, social security card (or ITIN card) for everybody filed on the tax return, a copy of their 2022 tax return if filed, and other relevant tax documents. For a complete list of documents to bring to your appointment, please visit our website, UnitedWayIRC.org.

There are five convenient locations throughout Indian River County. Each site operates a different schedule, and appointments are required for all locations:

United Way Center located at 1836 14th Avenue, Vero Beach, FL 32960

Mondays & Wednesdays from 4:00 PM to 8:00 PM

Fridays & Saturdays from 9:00 AM to 5:00 PM

United Against Poverty located at 1400 27th Street, Vero Beach, FL 32960

Tuesdays from 2:30 PM to 6:30 PM

Thursdays from 10:00 AM to 2:00 PM

Coastal Community Church located at 4720 86th Street, Sebastian, FL 32958

Mondays from 4:00 PM to 8:00 PM

Literacy Services located at 21 S. Cypress Street, Fellsmere, FL 32948

Thursdays from 4:00 PM to 8:00 PM

Fellsmere Community Enrichment Program located at 10072 Esperanza Circle, Fellsmere, FL 32948

Every other Tuesday from 4:00 PM to 8:00 PM

This will be the fourteenth year United Way of Indian River County has provided free tax preparation through IRS-certified volunteers that are generously contributing their time and expertise to building a stronger community. In 2023, nearly 1,550 returns were filed through this program, with an average household refund of $776, resulting in over $1.5 million in state and federal refunds. VITA is a financial stability initiative supported by the United Way of Indian River County.

________________________________________________________________________________________________________________________________________________________

United Way of Martin County

Call for more info starting Monday, January 15, 2024.

United Way office

10 SE Central Parkway, Suite 101

Stuart, FL 34994

What is VITA?

The Volunteer Income Tax Assistance (VITA) Program provides free income tax return preparation to hard working taxpayers earning up to $60,000 annually per household. VITA helps working families take advantage of all of the tax credits they are eligible for including the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and education credits. IRS Certified volunteers from the community help prepare basic, current-year tax returns for eligible taxpayers free of charge.

Who can benefit from VITA?

Martin County individuals and families who earn up to $60,000 annually are eligible to receive free tax preparation services.

When can I visit a VITA site?

Please call the United Way office at 772-283-4800 to schedule your appointment. All appointments will take place Monday - Wednesday evenings by appointment ONLY at the United Way office at 10 SE Central Parkway, Suite 101 in Stuart.

Please make sure that you gather all of the necessary information (listed below) to avoid any delays.

What information will I need to provide?

The following items are needed to prepare your tax return:

Proof of identification (copy of photo ID such as a driver’s license)

Social Security cards for you, your spouse and dependents or a Social Security number verification letter issued by the Social Security Administration.

Birth dates for you, your spouse and dependents on the tax return.

Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers.

Interest and dividend statements from banks (Forms 1099)

If you are self-employed, a list of expenses that cannot exceed $10,000.00. If you will have a negative income loss, then your return is out of scope for a VITA site and we cannot do it.

Forms 1095-A, B or C, Affordable Health Care Statement

Form 1098 to verify any home mortgage interest claimed.

IRS Letter 6419, 2021 Advanced CTC

Form 1098T if claiming tuition paid as well as tuition payment information from the college or university.

A copy of last year’s federal return, if available.

Proof of bank account routing and account numbers for direct deposit such as a blank check.

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms.

Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number.

Who to contact for additional information?

Call 772-283-4800 for more information or to register.

MyFreeTaxes.com

Besides our VITA program, if you prefer filing online, we’ve got that covered too. Visit MyFreeTaxes to file for free 24 hours a day, 7 days a week. No matter your income, MyFreeTaxes can help you take advantage of all the tax credits and deductions you qualify for!

In addition to the convenience of filing at a time that works for you, MyFreeTaxes utilizes secured software, so you have the peace of mind that your information is safe. MyFreeTaxes also offers help with filing questions through phone, chat or email.

For more information, contact Kathleen Stacey.

United Way of St. Lucie & Okeechobee

United Way of St. Lucie & Okeechobee is giving local families a helping hand by providing free tax preparation services.

There are two options to choose from:

Volunteer Income Tax Assistance (VITA) services will be provided by appointment only this year.

MyFreeTaxes.com is a website to help you file your taxes for free.

About the Tax Credits:

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) programs provide federal tax benefits for low and moderate-income workers. The EITC offsets some or all of those families' federal income taxes and in many cases provides a supplemental source of income to help offset other taxes, including sales and payroll taxes. In order to claim the credits, eligible workers must file a tax return.

*Attendees interested in having their taxes filed at the VITA site must bring the following documents: W-2 and 1099, Social Security card (yours and your dependents'), photo identification, and should bring a copy of 2021 tax return.

For more information, please contact 211 or the United Way of St. Lucie & Okeechobee at (772) 464-5300.

What to Bring to your VITA Appointment:

Please bring the following with you:

Proof of identification (photo ID).

Social Security cards for you, your spouse and dependents.

An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number.

Proof of foreign status, if applying for an ITIN.

Birth dates for you, your spouse, and dependents on the tax return.

Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers.

Interest and dividend statements from banks (Forms 1099).

Health Insurance Exemption Certificate, if received.

A copy of last year’s federal and state returns, if available.

Proof of bank account routing and account numbers for direct deposit such as a blank check.

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms.

Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number.

Forms 1095-A, B and C, Health Coverage Statements.

Copies of income transcripts from IRS and state, if applicable.

Additional Free Tax Assistance

IRS FREE FILE ONLINE

Annual income limit of $72,000 or less

UNITED WAY’S MY FREE TAXES ONLINE

Annual income limit of $64,000 or less

Become a Volunteer Income Tax Assistance (VITA) volunteer!

We are looking for volunteers for the upcoming tax season. You can help local families succeed! We will provide all the training – no experience required. Learn more and sign up here.